Oct 26, · The Internal Revenue Service has resurrected a form that has not been used since the early 1980s, Form 1099NEC (the NEC stands for nonemployee compensation) This form will be used to report nonemployee compensation in place of the 1099MISC, which has been used since 19 to report payments to contract workers and freelancersForm 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeSep 17, · Form 1099NEC is used to report nonemployee compensation Compensation only needs to be reported on Form 1099NEC if it exceeds $600 for the previous tax year Nonemployee compensation was previously included on the 1099MISC form

Solved Re 1099 Nec Box 1 Non Employee Compensation Doubl

Form 1099 nec nonemployee compensation worksheet schedule c

Form 1099 nec nonemployee compensation worksheet schedule c-Dec 03, · If you need assistance with filing 1099NEC or have questions related to this issue, please give this office a call You can complete the 1099NEC worksheet and forward it to this firm to prepare 1099s Also, make sure you have all of your nonemployee workers or service providers complete a Form W9 forThe nonemployee compensation reported in Box 1 of Form 1099NEC is generally reported as selfemployment income and likely subject selfemployment tax Payments to individuals that are not reportable on the 1099NEC form, would typically be reported on Form 1099MISC

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

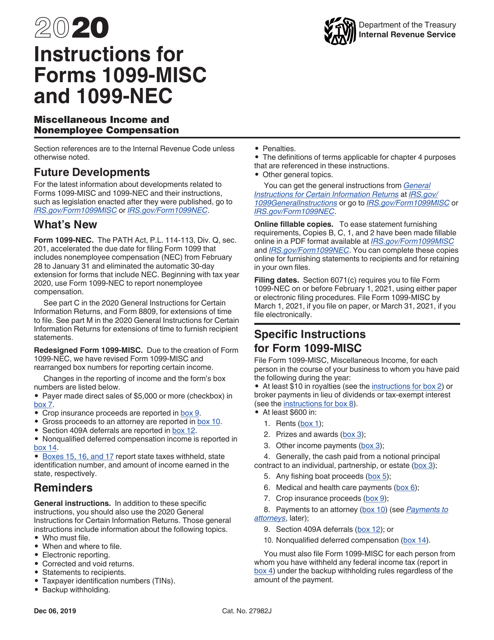

Jul 13, · Form 1099NEC is the new IRS form starting in , and it replaces Form 1099MISC for reporting nonemployee payments The IRS has released the Form 1099NEC to report nonemployee payments This move affects almost all businesses within the US who need to report nonemployee compensationMar 02, · The Internal Revenue Service (IRS) released its final version of Form 1099NEC, Nonemployee Compensation, on December 6, 19, to be used for reporting current and deferred compensation paid toAug 05, · Form 1099NEC reports Nonemployee Compensation to payees and the IRS The return was used until 19 when Form 1099MISC added Nonemployee Compensation to its reporting repertoire 1099MISC reported nonemployee compensation in Box 7 for over thirty years

Apr 30, 21 · The EF transmission record will now contain the necessary information when federal Form 1099NEC, Nonemployee Compensation, is included in the return, preventing reject "ME" Michigan Cities Update 21 Individual Package Per MI Public Act 7, the following return and payment due dates have been updatedWhat types of compensation needs to be reported on Form 1099NEC?If you earn more than $600 in payments during the last year from the DoorDash app, then you will receive a Form 1099NEC Nonemployee Compensation from Payable In the past they would send a 1099MISC form, but the 1099NEC is replacing that form as of the year

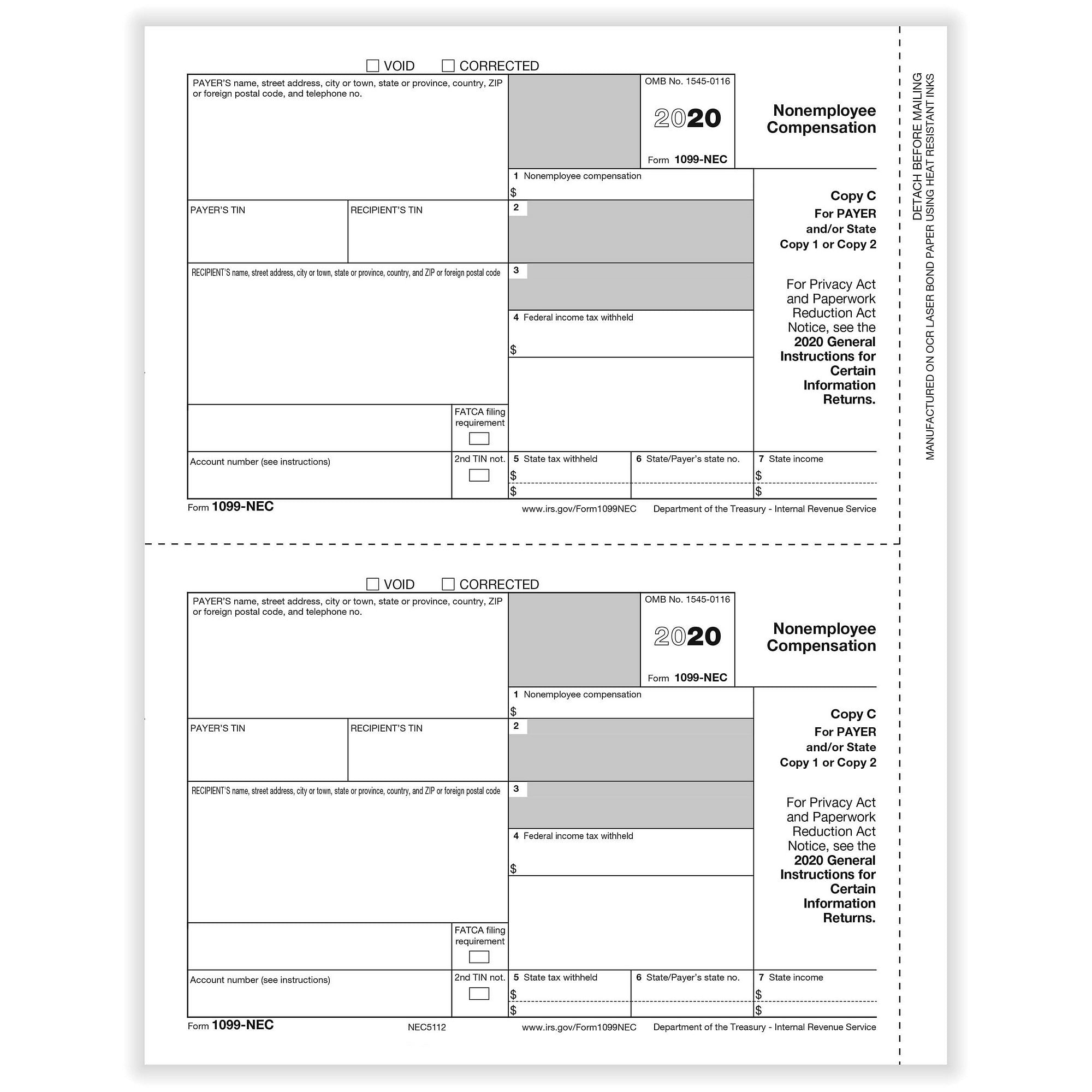

Notes When With nonemployee compensation or Without nonemployee compensation are selected, the application ignores any manual selection or deselection of recipients in the Actions > Edit Payroll Tax Forms screen;Download Fillable Irs Form 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Nonemployee Compensation Online And Print It Out For Free Irs Form 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal FormsDec 03, · Again, report nonemployee compensation on Form 1099NEC Nonemployee compensation typically includes fees, commissions, prizes, and awards File Form 1099NEC for each person you paid the following to during the year $600 or more in Services performed by someone who is not your employee (eg, independent contractor)

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

5udejplgshrwvm

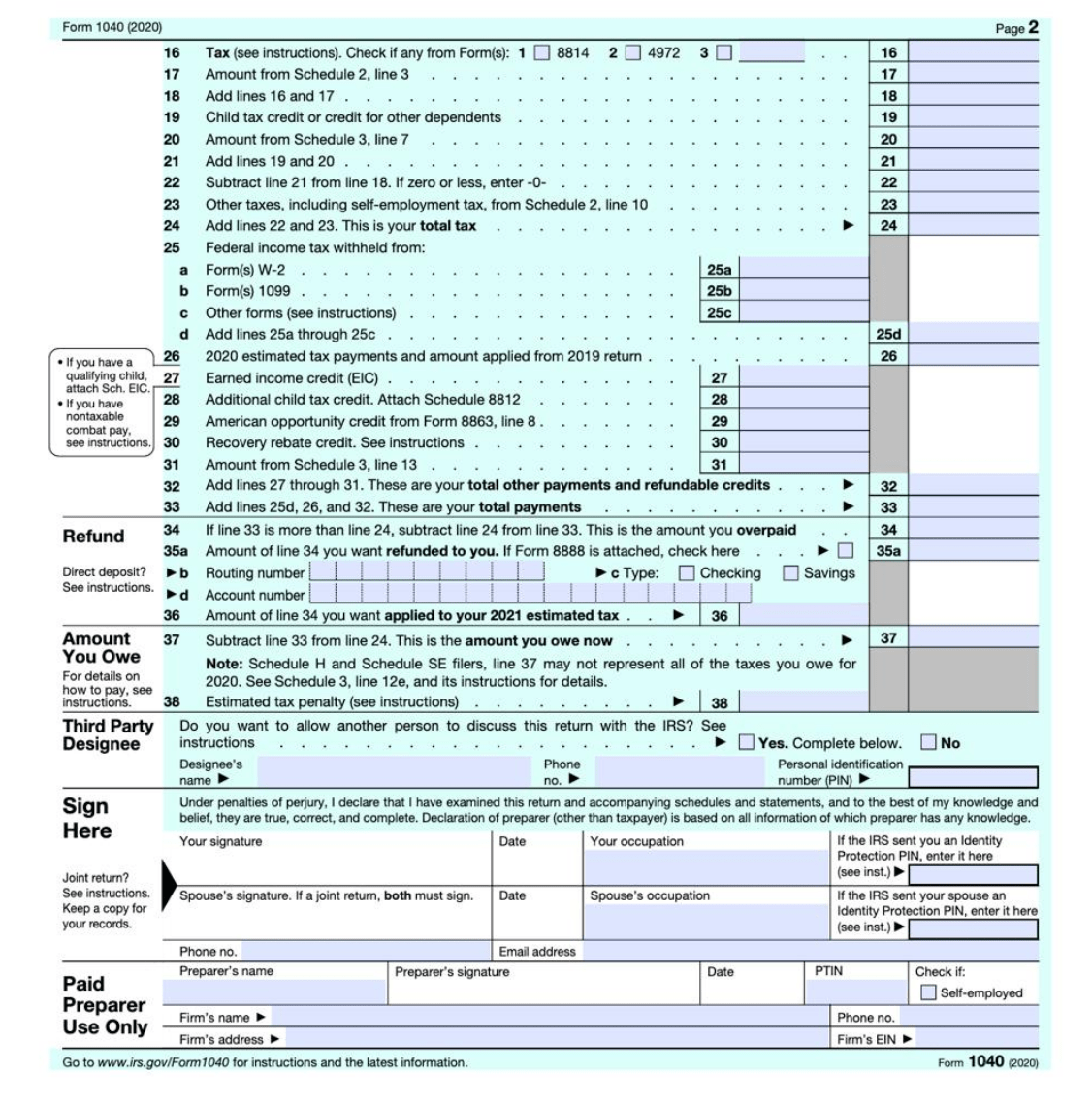

If the Form 19 should not be present in the return and the Nonemployee compensation should flow to 1040 Line 21 as other income For instructions on this, see our solution on how to enter nonemployee compensation so it flows to Form 1040, Line 21 in a 1040 return using worksheet viewJan 07, 21 · Update The IRS has released a new form specifically for "NonEmployee Compensation", which is the main pay type used by our clients on a 1099Misc The new form is a Form 1099NEC The rules mentioned in this blog are still in effect and can be applied to FormJan 08, 21 · The nonemployee compensation reported in Box 1 of Form 1099NEC is generally reported as selfemployment income and likely subject selfemployment tax Payments to individuals that are not

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

Self Employed Vita Resources For Volunteers

Nov 25, · IRS Form 1099NEC is filed by payers who have paid $600 or more as nonemployee compensation for an independent contractor or vendor (ie, nonemployee) in a calendar year The form must be filed with the IRS and also a copy of the return must be furnished to the recipient 2 Who must file Form 1099NEC?Sep 15, · 1099 Worksheet The Internal Revenue Service has resurrected a form that has not been used since the early 1980s, Form 1099NEC (the NEC stands for nonemployee compensation) This form will be used to report nonemployee compensation in place of the 1099MISC, which has been used since 19 to report payments to contract workers and freelancersTo print a custom set of recipients, set the filter to All recipients and unmark the Print all recipients checkbox in the Form Selection grid of the Process Client 1099

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

Time To Send Out Those 1099s Krs Cpas

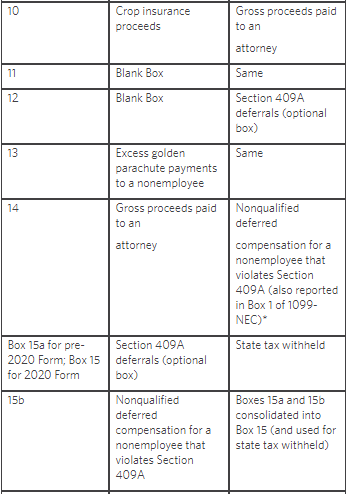

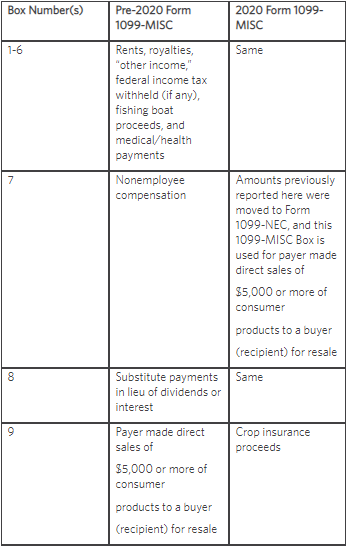

Apr 29, · If you make qualifying payments to nonemployees in , you'll need to file Form 1099NEC in the 21 tax season This incoming form is replacing Form 1099MISC for reporting nonemployee compensation Here's everything you need to know about Form 1099NEC—when to use it, how to fill it out, and filing deadlinesIf you need assistance with filing 1099NEC or have questions related to this issue, please give this office a call You can complete the 1099NEC worksheet and forward it to this firm to prepare 1099s Also, make sure you have all of your nonemployee workers or service providers complete a Form W9 forDec 30, · Form 1099NEC Overview Previously, you would be including nonemployee compensation in Box 7 on Form 1099MISC, but now it is turned into "Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale" In , "Nonemployee Compensation" must be reported by using Form 1099NEC

Solved Re 1099 Nec Box 1 Non Employee Compensation Doubl

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

All nonemployee compensation must be reported on the Form 1099NEC Nonemployee payments are any person or business you've paid more than $600 in a tax year in exchange for performance of servicesHere is the basic run down of the rules for reporting compensation, including bonuses paid to employees vs independent contractors If the recipient is an employee, the employer should always report wages, salaries, fees, bonuses, commissions, tips and other compensation as income on the employee's W2, not on a 1099Sep 15, · 1099 Worksheet The Internal Revenue Service has resurrected a form that has not been used since the early 1980s, Form 1099NEC (the NEC stands for nonemployee compensation) This form will be used to report nonemployee compensation in place of the 1099MISC, which has been used since 19 to report payments to contract workers and freelancers

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

Feb 05, 21 · Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 To access the Form 1099NEC Worksheet Press F6 on the keyboard to open the Forms List Type 99N on your keyboard to highlight the 1099NEC Wks Select OKGenerally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not your employeeForm 1099NEC replaces Form 1099MISC with box 7 data as the new form for reporting nonemployee compensation This change is for the tax year, which are filed in 21 Why the Change Occurred Back in 15, the PATH (Protecting Americans from Tax Hikes) Act changed the due date for 1099MISC forms with data in box 7 from March 31 to

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Ready For The 1099 Nec

Form 1099NEC, Nonemployee Compensation Taxpayers who are independent contractors should receive Form 1099NEC showing the income they earned from payers who are required to file Forms 1099 The use of Form 1099NEC to report payments to independent contractors is new for The amount from Form(s) 1099NEC, along with any otherOct 02, · Article Highlights 1099NEC Has Been Resurrected NonEmployee Compensation Combating Fraudulent Filings Due Dates Form W9 Penalties 1099 Worksheet The Internal Revenue Service has resurrected a form that has not been used since the early 1980s, Form 1099NEC NEC stands for nonemployee compensation This form will be used to report nonemployee compensationMay 05, · The 1099NEC is a different form than the 1099MISC Form 1099NEC reports nonemployee compensation, whereas Form 1099MISC reports other miscellaneous income Starting in , businesses need to report nonemployee compensation on a separate Form 1099NEC in addition to any other miscellaneous income reported on Form 1099MISC

How Do I Link To Schedule C On My 1099 Misc For Bo

What Is Form 1099 Nec Who Uses It What To Include More

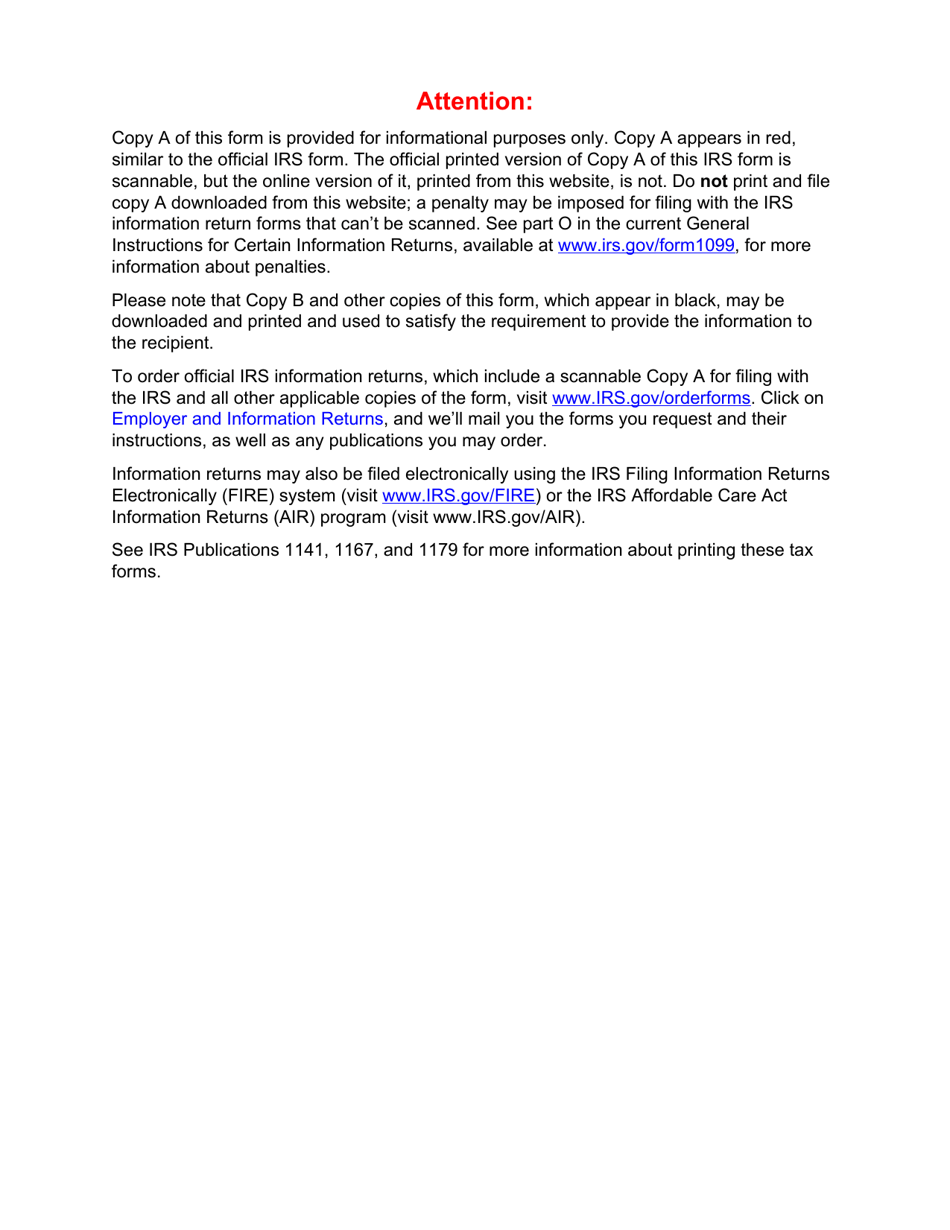

The new Form 1099NEC, NonEmployee Compensation is now exclusively used to report compensation of $600 or more paid to nonemployees It replaces the 1099MISC used in the past Form 1099MISC is still being used, but has been relegated to less common forms of business payments, like royalties, rents, direct sales, cropinsurance proceeds, etcSep 28, · The Internal Revenue Service has resurrected a form that has not been used since the early 1980s, Form 1099NEC (the NEC stands for nonemployee compensation) This form will be used to report nonemployee compensation in place of the 1099MISC, which has been used since 19 to report payments to contract workers and freelancersForm 11H US Income Tax Return for Homeowners Associations 11/23/ Inst 1099MISC and 1099NEC Instructions for Forms 1099MISC and 1099NEC, Miscellaneous Income and Nonemployee Compensation 21 11/23/ Inst 1099DIV

Form 1099 Nec For Nonemployee Compensation H R Block

F O R M 1 0 9 9 N E C W O R K S H E E T Zonealarm Results

Jul 28, 19 · The Internal Revenue Service has resurrected a form that hasn't been used since the early 1980s, Form 1099NEC, Nonemployee Compensation, with a draft version available for preview on its website Since 19, the IRS has required businesses to instead file Form 1099MISC for contract workers and freelancersFeb 02, 21 · If you received the Form 1099NEC for a nonemployee compensation, you should enter the information in both Form 1099NEC and Schedule C sections I will suggest you to add the Schedule C See below for instructions You would start from the 1099NEC section under "1099MISC and Other Common Income"Nov , · NEC stands for "nonemployee compensation," and Form 1099NEC includes information on payments you made during the previous calendar year to nonemployees You must send a 1099NEC form to any nonemployees to whom you paid $600 or more during the year This form is NOT used for employee wages and salaries Use Form W2 to report these payments

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Freelancers Independent Contractors Archives Taxgirl

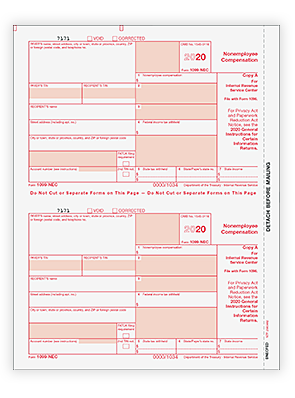

Form 1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue ServiceFeb 11, 21 · Beginning with tax year , businesses that make contractor payments must report them on Form 1099NEC, Nonemployee Compensation Previously, businesses used Form 1099MISC, Miscellaneous Income, to report nonemployee compensation and a number of miscellaneous payments to vendors (eg, rent)Feb 08, 21 · Income reported on Form 1099NEC must be reported on Schedule C, the program needs to link these two forms together to be sure that it is reported correctly and on the right form If you have already entered your 1099NEC, you will need to revisit the section where you entered the Form 1099NEC on its own and delete that entry Follow these steps

1099 Nec Non Employee Compensation Payer State Copy C Cut Sheet 400 Forms Pack

Form 1099 Nec Nonemployee Compensation 1099nec

Dec 03, · If you need assistance with filing 1099NEC or have questions related to this issue, please give this office a call You can complete the 1099NEC worksheet and forward it to this firm to prepare 1099s Also, make sure you have all of your nonemployee workers or service providers complete a Form W9 forDownload Printable Irs Form 1099misc, 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Online And Print It Out For Free Irs Form 1099misc, 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal FormsJan 05, 21 · If you need assistance with filing 1099NEC or have questions related to this issue, please give this office a call You can complete the 1099NEC worksheet and forward it to this firm to prepare 1099s Also, make sure you have all of your nonemployee workers or service providers complete a Form W9 for

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Federal Tax Forms Order Quickbooks Tax Forms To Print

Nov 17, · Changes have been made to the 1099 worksheet, vendor maintenance, and global vendor change to support the 1099NEC The 1099NEC will be used to report nonemployee compensation (previously 1099MISC box 7) Note Due to the creation of Form 1099NEC, there will be a revised Form 1099MISC

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

1099 Nec Instructions Reporting Nonemployee Compensation For Youtube

Irs Brings Back Form 1099 Nec Cash Tax Accounting

Taxbandits Payroll Employment Tax Filings Medium

Your Ultimate Guide To 1099s

Form 1099 Nec How To Fill Out This New Form Youtube

1099 Nec Schedule C Won T Fill In Turbotax

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

The 1099 Misc Filing Date Is Just Around The Corner Are You Ready Tarlow Cpas

F O R M 1 0 9 9 N E C W O R K S H E E T Zonealarm Results

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

Form 1099 Nec Is Coming Here S What You Need To Know

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Miscellaneous Income

What Is Form 1099 Nec Turbotax Tax Tips Videos

/how-to-prepare-1099-misc-forms-step-by-step-397973-final-HL-ccf162add47a4d61bb61fca1ea3e3c62.png)

How To Prepare 1099 Nec Forms Step By Step

5 Tips For 1099s In Quickbooks Online Insightfulaccountant Com

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Businesses Get Ready For The New Form 1099 Nec Sensiba San Filippo

The New Irs Form 1099 Nec Summarized

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

What Is A Schedule C 1099 Nec

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Nec And 1099 Misc What S New For Bench Accounting

Ready For The 1099 Nec

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Tax Forms Archives Taxgirl

What Should I Put Into The Blank Next To Schedule

1099 Nec Non Employee Compensation Blank Face Backer 11 Z Fold 1099necb

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

New Irs Rules For Reporting Non Employee Compensation With Form 1099 Nec Complyright

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

1099 Nec Conversion In

Irs Releases Form 1040 For Tax Year Taxgirl

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Form 1099 Nec What Is It

Ready For The 1099 Nec Spatola Company Cpa Inc

Form 1099 Nec Is Coming Here S What You Need To Know

Form 1099 Nec Nonemployee Compensation 1099nec

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Taxbandits Payroll Employment Tax Filings Medium

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Setting Up And Processing Form 1099 For Recipients

Solved 1099 Nec Software Issue Page 4

Freelancers Meet The New Form 1099 Nec

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Taxbandits Payroll Employment Tax Filings Medium

1099 Nec Non Employee Compensation 2 Up Blank W Copy B Backer Cut Sheet No Stub 1 000 Forms Ctn

Your Annual Reminder To File Worker Form 1099 Nec Nissen And Associates

1099 Misc Form Fillable Printable Download Free Instructions

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Prepare To Issue New Irs Form 1099 Nec By Jan 31 21 Ohio Cpa Firm Rea Cpa

5 Tips For 1099s In Quickbooks Online Insightfulaccountant Com

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Excel1099 How To File Form 1099 Nec With Excel Cute766

Prepare Now For 1099 Reporting Centerbase

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

0 件のコメント:

コメントを投稿